Dublin’s Housing Bubble

In this article, Eoghan Brunkard discusses rising rents and property prices following the release of Daft.ie’s quarterly report. The Government/Local Authorities approach to the problem are discussed as are alternatives. Is Ireland and more Specifically Dublin heading towards another Property Bubble?

The quarterly Daft property report was released recently providing good news for home sellers but bad news for everyone else. Across the State the average house price has risen by 14% (from €170, 000 to €195, 000), while it has risen by 25% in Dublin, and by 29% (now at €252, 995) in the inner city, this includes our own Dublin 8. The inflation in ‘asking prices’ in the Capital is at its highest since records started in 2006. At the same time, the fraction who believes that house prices are indicative of good value has fallen dramatically in Dublin, from 42% in 2013 to 15% in 2014.

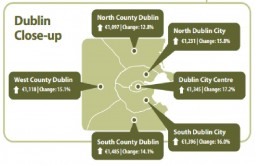

Correspondingly, data from the second quarter Daft report on rental abodes from last summer also show a marked increase in rates. Rents across the State have risen on average 10.8% in the last year, while the area of Dublin City (including Dublin 8) saw an increase of 17.2%, the largest in the State. Rents are now just 9% below peak values in 2007 in the Capital’s city centre.

Image Credit Daft.ie

So what is driving the increase in home prices and rent? According to Daft’s economist Ronan Lyons, the problem is twofold. Firstly, as the Daft report finds itself, Dublin home buyers believe house prices will rise by a further 12% in the next 12 months. This expectation may cause speculators to refrain from selling their own properties as there is a general consensus that house prices have not yet peaked. Secondly and partly influenced by the former, there are simply not enough dwellings on the market to meet demand. As Mr Lyon explains himself:

“The total number of properties on the market on October 1st was just over 30,000, the lowest figure since March 2007. Across Leinster, and in Dublin in particular, supply shortages remain and this has helped push up values by a third in Dublin in just two years. The concern is that this supply shortage is now feeding into expectations. While price rises driven by shortages can be stopped by increasing supply, tackling price rises driven by expectations is significantly trickier.” Link Here

This is certainly a worrying analysis and was in part agreed with by senior Government advisor Conor Skehan (head of the Housing Agency). Mr Skehan argued in a recent Sunday Independent article that the issue may not be a shortage of houses but a shortage of houses for sale. Irish Independent Link .

He was more optimistic however, and believed that market mechanisms would eventually correct the problem. He believed more and more people would eventually sell properties that they are withholding as prices increased. Eventually, the increased properties on the market would cause property prices to stabilise.

This may be presumptive, as Mr Lyons is not alone in his diagnosis that there are simply not enough dwellings sitting idle. The Chief economist with Goodbody Stockbroker argued that there was quite simply not enough time to build enough houses to deal with the crisis Journal Article here .

While Dr Rory Hearne argued in a recent Irish Examiner article that an additional 8000 units a year in Dublin would need to be built to meet rising demand Irish Examiner Link. Knowing there is a shortage of dwellings, speculators may refrain from selling until a later date, increasing inflation and creating another housing bubble.

In either situation, if the Government/Local Authorities chose to be more proactive in their housing policy (specifically provision thereof) they could go some way to deflating the price in both home buying and rental markets. So what are the Government/Local Authorities doing?

Well firstly, the Government have introduced new legislation to countermand the controversial law that allowed developers to give money or land instead of donating 20% of a proposed development for social housing. The new law will demand 10% of development be committed to public housing by developers. More social housing will ease pressure on people in the lower income bracket who are currently struggling with rising rents and who quite simply cannot afford homes. It will also ease demand in the private rented sector. Irish Times Article here

The big difference here is that this is public housing and not affordable housing. Affordable housing as an idea has come under scrutiny, as a provision of the contract entailed having to live in the property for at least 10 years before it could be sold meaning many are now living in properties that are too small for their needs or too far from where they now work. Public housing however, means that the property is retain by local authority and rented to the tenant.

The new legislation will also see a 5% levy placed on the value of derelict sites as well as a “use it or lose it” clause for land zoned for development to reduce speculation or land hoarding. It is hoped that these measures will free up land in the city for development. However, there are no criteria introduced to insure that these properties need be residential.

Continuing on this idea of “public housing”, a new initiative from Dublin City Council has advertised for developers to express interest in the construction of 1500 houses on 30 hectares of land throughout the outer city. The partnership will see the DCC provide the land and developers will build a mix of private/social housing unlike previous partnership arrangements both private and social properties will be for the rental market. It is hoped that the private rent will offset the cost of building the social units and hopefully, incentive private investment.

Are these measures enough? And if not what else can we do to stem the rising prices State wide and in Dublin?

Dr Hearne argues that Irish housing policy central failing is its core principle of home ownership. He offered the following suggestions:

- NAMA have its purpose changed to a non profit social housing organisation, as it stands its slow release of property onto the market serves to inflate the housing bubble.

- Local Authorities be given State guarantees to allow them to borrow on the financial market for housing projects.

- A temporary .5% levy on multinational profits, which will raise €350 million specifically for housing projects.

- Introduce mortgage debt write downs, rent controls, and a massive social housing building programme through housing associations

His illuminating article can be read Irish Examiner Article here

In conclusion, there is both a shortage of housing stock and rising prices/rents for homes in the city being fed by said shortage and expectations that prices will continue to rise. Government measures, while a positive step are not enough to stem this rising bubble and require more radical solutions such as increasing public housing stock and putting pressure on developers to utilise derelict sites. A change of emphasis on housing policy from ownership to rental should also be considered in light of new possible private/public partnerships.